Quantbase

Strategies

FAQ

Become a partner

Sign in

Get started

Invest alongside

Austin Hankwitz

Austin Hankwitz

Automated investing in Austin Hankwitz's quantitative strategies and ideas, fully managed on your behalf by Quantbase.

RoundlyX Global Arms Race and Conflict Fund

Dividend Growth Strategy

2.75/5

Risk score

Austin Hankwitz's

investing strategies

investing strategies

RoundlyX Global Arms Race and Conflict Fund

Dividend Growth Strategy

2.75/5

Risk score

View disclosures and methodology

How it works

Austin Hankwitz expressed to us his desire to make it as easy as possible for his community to build wealth alongside him – so we did just that. To get started, create an account on Quantbase to automate your investing, then begin monitoring and managing your investments either on our app or desktop portal. If you already have a Rate of Return subscription, access to Austin's strategies is complimentary.

Create a Quantbase account to automate your investments.

Subscribe to Austin Hankwitz's strategies

Monitor and manage your investments

Rate of Return

Rate of Return is Austin’s Substack newsletter, where he publishes curated financial news, analysis, and commentary for more than 8,200 investors. Rate of Return was a 2021 Substack Featured Publication.

Access to Austin’s strategies normally costs $5/month, but Rate of Return premium subscribers get access for free! You can check out Austin’s "Rate of Return" here .

Our founders

We're a team of engineers and investors who have built and invested in quantitative trading strategies for almost a decade. We're passionate about making quantitative investing accessible to everyone and put our money where our mouth is.

About Quantbase

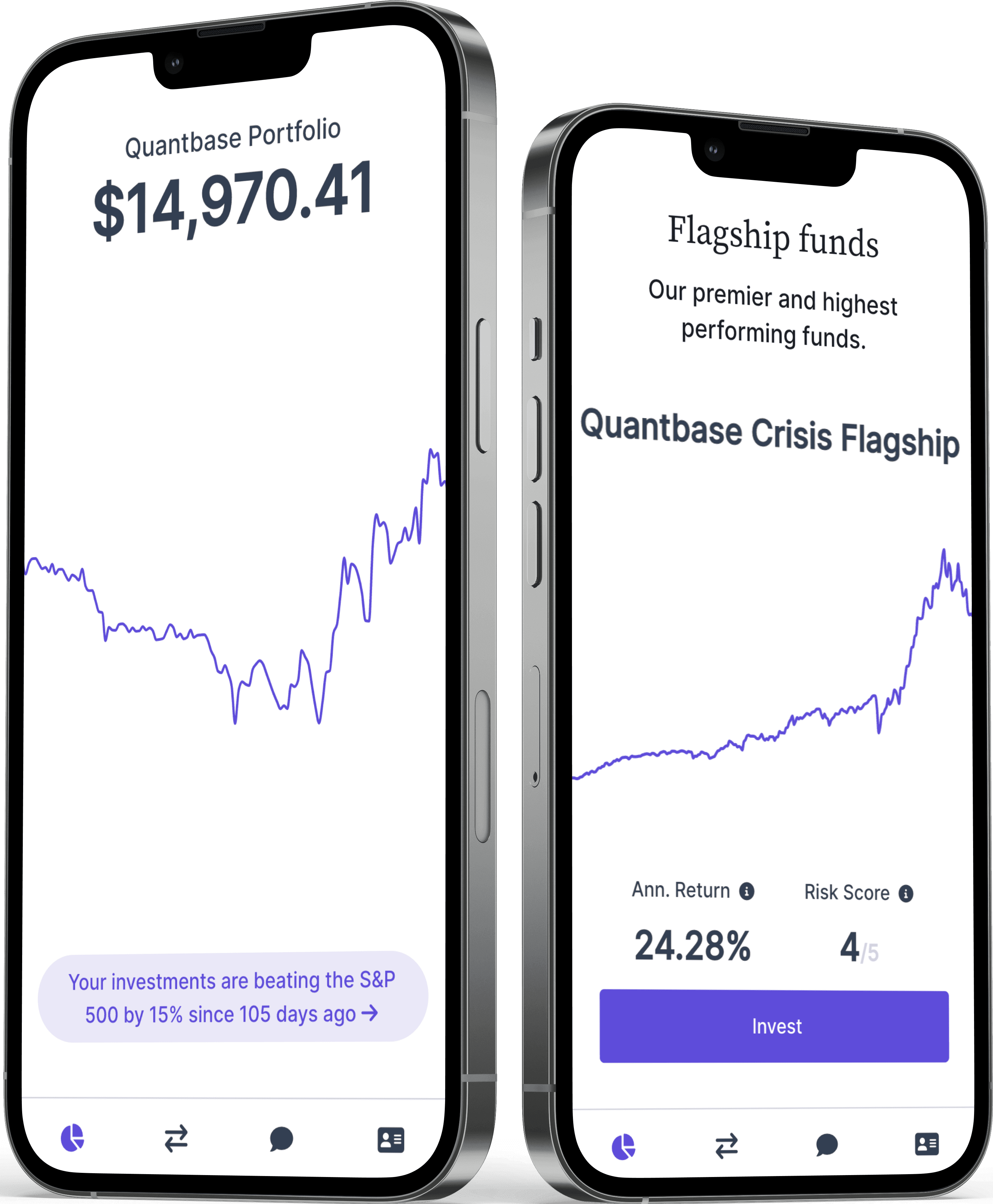

Quantbase is an investment platform that builds quantitative and rules-based strategies on behalf of financial professionals, enterprises, creators, and other thought leaders. We then automate the execution of those strategies for anyone who wants to participate.

Quantbase is an SEC-registered investment adviser. All investments made through our platform are SIPC-insured and secured with bank-grade encryption. There are no lock-ups and you can start with just $50.

Quantbase's world-class engineering and design teams strive to deliver a first-class mobile app and desktop website made specifically for the modern investor.

How does Quantbase work?

You move money from your bank or investment account onto Quantbase, then into one of our automated strategies. Once invested, Quantbase fully manages the strategies you're invested in, ensuring rebalances into the proper asset allocations at the proper times, as informed by the strategy. When the professionals you trust make money, you also make money.

How much does Quantbase cost?

Our fee structure is a simple $10/mo for accounts under $12,000 or 1% annually of the managed assets for accounts greater than $12,000*. For example, $15,000 invested would only be $12.50/mo. Our partners may charge a separate subscription fee for access to their strategies.

For Statis clients, we offer a competitive management fee of 0-2% depending on the client, and in some cases (qualified investors only), performance fees may apply.

Where is my capital held?

Quantbase partners with Alpaca Securities LLC as our broker and custodian. All cash balances are FDIC-insured, and all investments are SIPC-insured through Alpaca. We manage your assets, while Alpaca holds the assets and executes the trades. Learn more about Alpaca here: https://alpaca.markets/broker#regulatory

How do you handle taxes?

We provide documents annually as they become available through your dashboard. As a quantitative hedge fund, most assets are traded frequently and taxed as short term capital gains, but our returns are high enough to compensate for the extra taxes.

Learn more

Ready to start investing?

Create an account in 5 minutes.